Trend reversal in 2022 for the Dutch passenger car market

Short-term outlook: Improved supply availability paves the way for recovery in H2

Since the outbreak of the Corona pandemic, the Dutch car market has only seen declining new registrations – but in 2022 we will see a significant growth of +10.5% for the first time.

However, 2022 starts slightly muted due to the lockdown extending into January and the economic burden of the Omicron variant. Also missing in Q1 are new registrations that were tactically brought forward to the end of 2021, allowing OEMs to bring down their EU CO2 emissions, avoid fines, and comply with EU regulation. Meanwhile fleet customers were able to secure the lower taxes that where valid until the end of 2021.

The outlook for the rest of the year, however, is more confident, as the semiconductor shortage will ease slightly from Q2 and significantly from H2 (Q3 & Q4). We therefore expect a markable increase in momentum in the passenger car market in the second half of the year. Likewise, a buoyant labour market, together with a weakening impact of the pandemic, will lead to an upswing in H2. In 2023, the passenger car market will grow by another 11.4 percent, albeit with a slightly negative progression over the year.

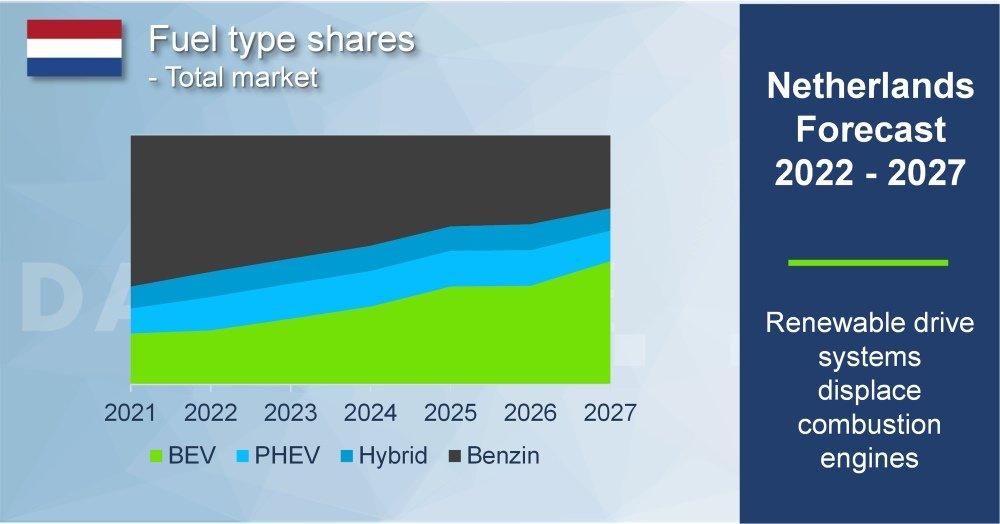

Electrified drive systems displace combustion engines

In 2022, electric drive types such as BEVs (+17.8%, 75,558 passenger cars) and PHEVs (+49.1%, 46,426 passenger cars) will particularly benefit from the upswing in the market. Petrol will continue to lose market share in 2022, as subsidies and regulations nudge more and more buyers towards EVs.

In the case of petrol cars, positive impulses from the improved availability of vehicles cannot outweigh the negative effects, so the fuel type remains at a level of 190,000 vehicles while the market grows. Diesel cars have already become a niche.

The rise of BEVs is being encouraged by the Dutch government’s intervention in the market. For example, only zero-emission cars can be sold from 2030. Consequently, the BEV market share will already be around 50 percent in 2027. Until then, additional registrations of BEVs can be expected again in the final months of 2025, where taxes on company registrations for BEVs will be increased.

Long-term outlook: External factors have a dampening effect

Looking at the long-term development of the passenger car market, there will be limits to the catch-up after the pandemic. Although new registrations will increase annually until 2025, this development will stagnate at a level of approximately 400,000 new registrations per year from then until 2027.

This corresponds to a level of approximately 94 percent of the mean value of the pre-Corona years (2015-2019). The reason for this is that increased home office use reduces the need for owning a car in the long term. The rental car channel can profit from this, as (when needed) people simply resort to short-term rental instead of having an own or a company car.

Historically matured forecasts

Dataforce has been offering a country forecast for the Netherlands since 2015. Since 2021, the forecast has been produced in cooperation with the Spanish forecasting experts from MSI. The market segment and fuel forecasts for the Netherlands are accessed either via a Tableau-supported dashboard (IRIS VIEWS) or via OLAP access (IRIS). In addition, forecasts for 7 other individual countries and Europe total are available. Individual reports are also possible.

Please find more information at: www.dataforce.de/en/forecast/

Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930382

E-Mail: julian.litzinger@dataforce.de

Junior Marketing Manager

Telefon: +49 (69) 95930-353

Fax: +49 (69) 95930-333

E-Mail: claudia.articek@dataforce.de

![]()