Dolly Varden Silver and Fury Gold Mines Complete Consolidation of the High Grade Silver-Gold Kitsault Valley Project

Shawn Khunkhun, chief executive officer of Dolly Varden, commented: “Completing the consolidation and unification of the Kitsault Valley Project is a pivotal event towards exploring and developing these high-grade precious metals assets in a globally recognized and coveted mining district. I look forward to working closely with our new partner and shareholder Fury to unlock the full potential through discovery, development, permitting and production. I would also like to thank Hecla for their continued financial and technical support.”

Tim Clark, CEO and Director of Fury, added: “The consolidation of these two adjacent properties is an exciting next step that benefits both our companies and only further enhances the upside opportunity of additional discovery of high-grade ounces along this prolific 15km mining trend. We look forward to working closely with the team at Dolly Varden and leveraging complementary skillsets, geology and infrastructure to continue to maximize value for investors in both companies.”

Pursuant to the ancillary rights agreement between Hecla Canada Ltd. (“Hecla”) and the Company dated September 4, 2012, Hecla exercised its anti-dilution right in respect of the Transaction and has acquired 9,048,539 common shares of Dolly Varden at a price of $0.59 per common share for aggregate proceeds to Dolly Varden of $5,322,351. As a result of this subscription, Hecla will maintain its equity interest in the Company of 10.25%.

Transaction Highlights

- Combined mineral resource base of 34.7 million ounces of silver and 166 thousand ounces of gold in the Indicated category and 29.3 million ounces of silver and 817 thousand ounces of gold in the Inferred category, solidifying the combined Homestake Project and DV Project (to be referred to together as the “Kitsault Valley Project”) as among the largest high-grade, undeveloped precious metal assets in Western Canada.

- Consolidation of two adjacent projects, allowing for numerous potential co-development opportunities with capital and operating synergies.

- Exposure to a large and highly prospective land package, with potential to further expand resources through additional exploration along a combined 15 km strike-length within a 163 km2 consolidated land package.

- Tim Clark, the Chief Executive Officer of Fury, and Michael Henrichsen, the Senior Vice President, Exploration of Fury, joining the Dolly Varden board.

Transaction Details

Pursuant to a purchase agreement dated December 6, 2021 (the “Purchase Agreement”), Dolly Varden has acquired 100% of Homestake Resource Corporation from Fury in exchange for a $5 million cash payment and the issuance of 76,504,590 common shares of Dolly Varden (“Common Shares”). Homestake Resource Corporation owns a 100% interest in the Homestake Project. As a result, Fury now own approximately 32.88% of Dolly Varden’s issued and outstanding Common Shares.

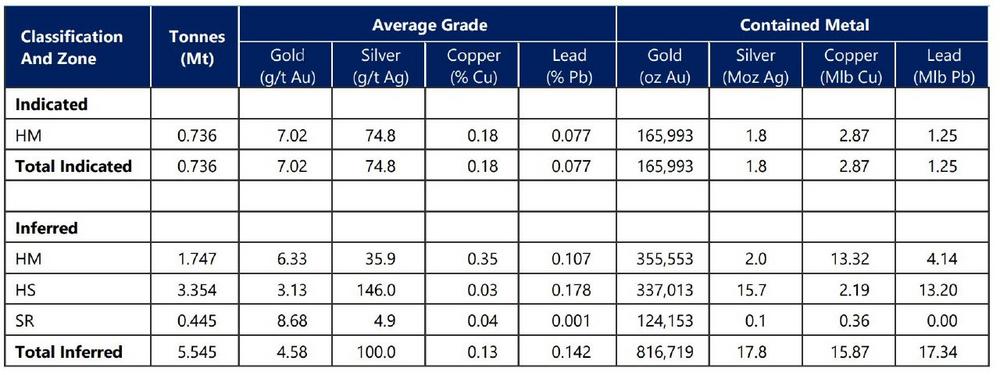

The Homestake Project hosts a Current Mineral Resource estimated to contain 165,993 ounces of gold and 1.8 million ounces of silver in the Indicated category and 816,719 ounces of gold and 17.8 million ounces of silver in the Inferred category within a 7,500 hectare land package located contiguous to and northwest of the DV Project. The DV Project hosts a Current Mineral Resource estimated to contains 32.9 million ounces of silver in the indicated category and 11.4 million ounces of silver in the Inferred category within a 7,800 hectare land package. For further resource disclosure, please see below under the heading “Technical Disclosure”.

The combined Homestake Project and DV Project would boast a collective mineral resource base of 34.7 million ounces of silver and 165,993 ounces of gold in the indicated category and 29.3 million ounces of silver and 816,719 ounces of gold in the inferred category, solidifying the combined Homestake Project and Dolly Varden Project, the Company’s existing project, as among the largest high-grade, undeveloped precious metal assets in Western Canada.

The close proximity of the Homestake Project and DV Project, combined with common infrastructure in the region, is expected to generate substantial co-development synergies for the consolidated Homestake Project and DV Project, to be called the “Kitsault Valley Project”, as the respective deposits are advanced in combination.

In connection with the Transaction, Dolly Varden and Fury have also entered into an investor rights agreement (the “Investor Rights Agreement”) granting Fury the right to appoint two nominees to the Dolly Varden board so long as Fury owns greater than 20% of the Common Shares outstanding. Should Fury own greater than 10% of the Dolly Varden Common Shares outstanding, Fury shall have the right to appoint one nominee to the Dolly Varden board. Additionally, the Common Shares issued to Fury are subject to a one-year hold period. The Investor Rights Agreement also contain certain customary re-sale

restrictions, voting and standstill conditions, and participation rights as agreed between Dolly Varden and Fury.

The Common Shares issuable to Fury will be subject to a contractual one-year hold which expires on February 25, 2023 and a statutory hold period of four months plus one day which expires on June 26, 2022. All Common Shares issued to Hecla will be subject to a statutory hold period of four months plus one day which expires on June 26, 2022.

Further information regarding the Transaction, the Purchase Agreement and the Investor Rights Agreement is provided in the Company’s management information circular dated January 24, 2022 (the “Circular”). The Circular is available under the Company’s profile on SEDAR at www.sedar.com and on the Company’s website at https://www.dollyvardensilver.com/investors/#special-meeting.

Advisors and Counsel

Haywood Securities Inc. (“Haywood”) has acted as financial advisor to Dolly Varden. Stikeman Elliott LLP acts as legal counsel to Dolly Varden.

Minvisory Corp. has acted as financial advisor to Fury. McMillan LLP acts as legal counsel to Fury.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on exploration in northwestern British Columbia. The DV Project consists of the namesake Dolly Varden silver property that hosts a unique pure silver mineral resource as well as the nearby Big Bulk copper-gold porphyry property. Adjacent to the DV Project, the Homestake Ridge Project hosts structurally controlled epithermal gold, silver and copper mineralization. Together, the consolidated DV Project and Homestake Ridge Project, to be referred to as the Kitsault Valley Project, create one large, high-grade precious metals project with further synergistic and exploration upside potential. The Kitsault Valley Project is considered to be highly prospective for hosting high-grade precious metal deposits, since it comprises the same structural and stratigraphic setting that host numerous other high-grade deposits (Eskay Creek, Brucejack). The Big Bulk property is prospective for porphyry and skarn style copper and gold mineralization similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

About Fury Gold Mines Limited

Fury Gold Mines Limited is a Canadian-focused exploration company positioned in two prolific mining regions across the country. Led by a management team and board of directors with proven success in financing and advancing exploration assets, Fury intends to grow its multi-million-ounce gold platform through rigorous project evaluation and exploration excellence. Fury is committed to upholding the highest industry standards for corporate governance, environmental stewardship, community engagement and sustainable mining. For more information on Fury Gold Mines, visit www.furygoldmines.com.

Qualified Person

The technical information contained in this news release has been approved by Rob van Egmond, P. Geo, Chief Geologist for Dolly Varden, who is a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Technical Disclosure

The Homestake resource estimate is based on the technical report with an effective date of January 20, 2022 and titled, “Technical Report and Updated Mineral Resource Estimate for the Homestake Ridge Gold Project, Skeena Mining Division, British Columbia” which was filed and is available on Dolly Varden’s SEDAR profile at www.sedar.com. The report has been prepared in accordance with NI 43-101, Companion Policy 43-101CP to NI 43-101, and Form 43-101F of NI 43-101.

Mineral resources are estimated at a cut-off grade of 2.0 g/t gold equivalent.

The Dolly Varden resource estimate is based on the technical report with an effective date of May 8, 2019, and titled, “Technical Report and Mineral Resource Update for the Dolly Varden Property, British Columbia, Canada” which was filed and is available on Dolly Varden’s SEDAR profile at www.sedar.com. The report has been prepared in accordance with NI 43-101, Companion Policy 43-101CP to NI 43-101, and Form 43-101F of NI 43-101.

A 150 g/t silver cut-off was chosen to reflect conceptual underground mining and processing cut-off grade.

Mineral Resources are not Mineral Reserves. Mineral resources which are not mineral reserves do not have demonstrated economic viability. There has been insufficient exploration to define the inferred resource as an indicated or measured mineral resource, and it is uncertain if further exploration will result in upgrading the resource to a measured resource category. There is no guarantee that any part of the mineral resource discussed herein will be converted into a mineral reserve in the future.

Forward Looking Statements

This release may contain forward-looking statements or forward-looking information under applicable Canadian securities legislation that may not be based on historical fact, including, without limitation, statements containing the words “believe”, “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “potential”, “unlocking” and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Dolly Varden to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward looking statements or information in this release relates to, among other things, potential synergies expected from the combination of the DV Project and Homestake Project and the development potential of the Kitsault Valley Project.

These forward-looking statements are based on management’s current expectations and beliefs and assume, among other things, the ability of the Company to successfully pursue its current development plans, that future sources of funding will be available to the company, that relevant commodity prices will remain at levels that are economically viable for the Company and that the Company will receive relevant permits in a timely manner in order to enable its operations, but given the uncertainties, assumptions and risks, readers are cautioned not to place heavy reliance on such forward-looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

For additional information on risks and uncertainties, see the Company’s most recently filed annual management discussion & analysis ("MD&A"), which is available on SEDAR at www.sedar.com. The risk factors identified in the MD&A are not intended to represent a complete list of factors that could affect the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

For further information: Shawn Khunkhun, CEO & Director, 1-604-602-1440, www.dollyvardensilver.com; Fury Contact Information: Salisha Ilyas, Vice President, Investor Relations, 1-437-500-2529, www.furygoldmines.com

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()