Debt, War, Inflation, Corona – Precious Metal Investments

Caused by the Corona crisis, many governments launched aid measures. Many EU countries such as Italy, Greece, France and Germany are sitting on enormous mountains of debt. The economy is thus supported, but the direction should actually change again. It is bad when, as now, one crisis is not yet over and the next one has already begun. So rising inflation, supply chain problems, high energy prices and high commodity prices, as seen in 2021, will be with us for a while. The last time inflation was as high as it is today, was around 30 years ago, but back then government bonds were yielding juicy interest rates compared to today. As a result, the euro has lost a lot of its purchasing power today.

The fact that energy costs are rising and fueling inflation is also due to the fact that Germany is shutting down nuclear power plants and has to buy in electricity. This is because solar and wind energy cannot fill the energy gaps in this country. This is noticeable in the country’s own energy needs and in goods, which have become more expensive due to higher energy prices. Central banks are buying up government bonds to prevent sovereign defaults. And the lower the interest rate, the less governments have to pay for their debts. The Corona pandemic and the Russia-Ukraine war and their consequences will still cost the states money. All in all, it is difficult to find the right investments today. Many investors are therefore looking around for safe investment opportunities and discovering the values of well-positioned gold companies.

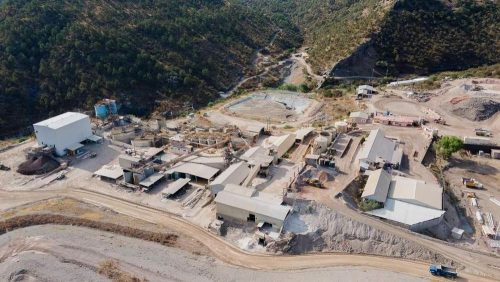

This includes Skeena Resources – https://www.youtube.com/watch?v=uqg6V-8gDKI -. The company is well on its way to success with the restart of the formerly producing Eskay Creek gold-silver mine in British Columbia.

Tarachi Gold – https://www.youtube.com/watch?v=IRnRAFCd8WI – is working on the prospective Tarachi project in the Sierra Madre Gold Belt and a project in Durango.

Current corporate information and press releases from Skeena Resources (- https://www.resource-capital.ch/en/companies/skeena-resources-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()