Gold – a stroke of luck

Hardly anyone believes in temporary inflation anymore. The debts of many countries have exploded. As recently as 2018, then Fed Chair Janet Yellen described a trillion-dollar debt for the US as unsustainable. Today, the deficit is several times higher. In absolute terms, the U.S. has the highest debt in the world. In the first half of 2022, they totaled more than $30 trillion. So, it’s one record level after another. Since the pandemic, the debt clock has been ticking faster and faster, and Russia’s attack on Ukraine is doing the rest. This conflict may go on for years. And Corona, too, may be with us forever. In this country, too, total public budget debt has risen sharply since 2020. At the end of March 2022, they stood at around 135 billion euros.

What happens when states get into debt crises? A look at history shows that the citizens have to take a beating, because in the end the states always get their money from the citizens. Whether in Austria, Denmark or South America, or even in Germany, there are enough examples. In 1922 and in 1948, there were debt crises and currency reforms in Germany, respectively. Compulsory bonds were demanded from the German citizen in 1922. In 1948, out of 100 Reichsmarks in the form of money deposits, life insurance policies, building savings contracts and so on, only 6.50 DM remained.

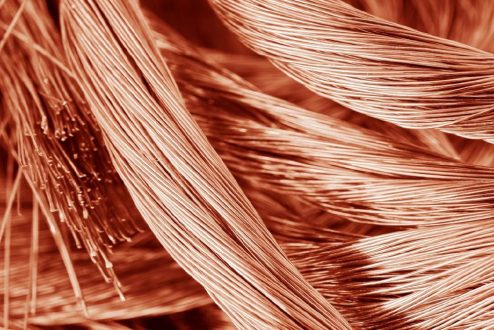

An expropriation took place. Real estate owners had to pay a compulsory levy. Today there is the EU, where all are responsible for the debts of European states. Today, value-preserving investments such as gold can help to preserve the value of savings. Gold shares should also be part of the provision. Here one could think of Calibre Mining or Osiko Development.

Calibre Mining – https://www.youtube.com/watch?v=y5HXuXb8Jhg – will produce an estimated 220,000 to 235,000 ounces of gold this year. The projects are located in Nicaragua and the USA.

Osisko Development – https://www.youtube.com/watch?v=5ILnR9Y6Vfc – owns the prospective Cariboo main project in British Columbia as well as other projects in Mexico, Canada and the USA.

Current corporate information and press releases from Calibre Mining (- https://www.resource-capital.ch/en/companies/calibre-mining-corp/ -) and Osisko Development (- https://www.resource-capital.ch/en/companies/osisko-development-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()