If it’s about electrification, it’s also about copper

Large quantities of copper are needed for increasing electrification. According to S&P Global, around 25 million metric tons of copper are consumed each year today, but this figure is expected to rise to around 50 million metric tons by 2035. Global efforts and investments in new technologies will therefore fuel the demand for copper. To ensure that copper does not become a scarce commodity, new mining projects must be driven forward. Recycling alone is not enough. China is one of the largest copper producers on earth. Around 1.8 million tons of copper came from China’s mines last year. The world’s largest copper producer is Chile, where around 5.6 million tons of copper saw the light of day. In total, global copper production in 2021 amounted to approximately 21 million tons. The market will have to be balanced by recycling and destocking. Nevertheless, a market deficit is expected, which should drive the price.

In the short term, the situation looks somewhat different, which offers the opportunity for favorable entrants. This is because corona outbreaks are still being recorded in various provinces in China, which can cause large-scale lockdowns and are thus not beneficial for metals such as copper. As a result, copper prices are also softening as metal prices are under pressure. Chile’s most important copper producer has already revised its production forecast for this year downwards. Operational problems are said to be the cause. The price is currently far from the record price of March, around 10,700 US dollars per ton of copper. Copper is used in mechanical engineering, the construction industry, the automotive sector and the electrical sector. Whether supply bottlenecks are accompanied by falling demand, an economic slowdown should in any case only be a temporary development. After all, in the longer term, copper is likely to be one of the favorites on the commodities market. This puts companies with copper in the spotlight, such as Hannan Metals or Kutcho Copper.

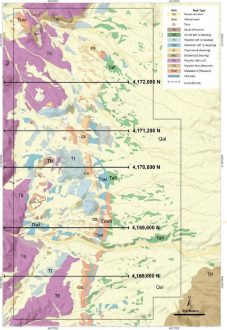

Hannan Metals – https://www.youtube.com/watch?v=fDNxCtW987s – owns vast tracts of land in Peru that contain copper, gold and silver.

Kutcho Copper – https://www.youtube.com/watch?v=sxgE0FrL-Dg – is advancing the prospective Kutcho project (copper, zinc) in British Columbia.

Current corporate information and press releases from Hannan Metals (- https://www.resource-capital.ch/en/companies/hannan-metals-ltd/ -) and Kutcho Copper (- https://www.resource-capital.ch/en/companies/kutcho-copper-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()