Fear for the savings – what to do?

The survey, commissioned by JP Morgan Asset Management, also shows that inflation concerns are even greater in Bavaria. 56 percent of savers are afraid of losing purchasing power. The cost of living has risen and so less can be saved, even though private provision is to be made for old age. Despite inflation, overnight or time deposit accounts are still very popular. There is also a difference between the total population of Germany and the Bavarians when it comes to shares. Four out of ten Bavarians own shares, but only three nationwide. More than 50 percent of those surveyed said they consider stocks, stock funds and ETFs to be good ways of protecting against inflation.

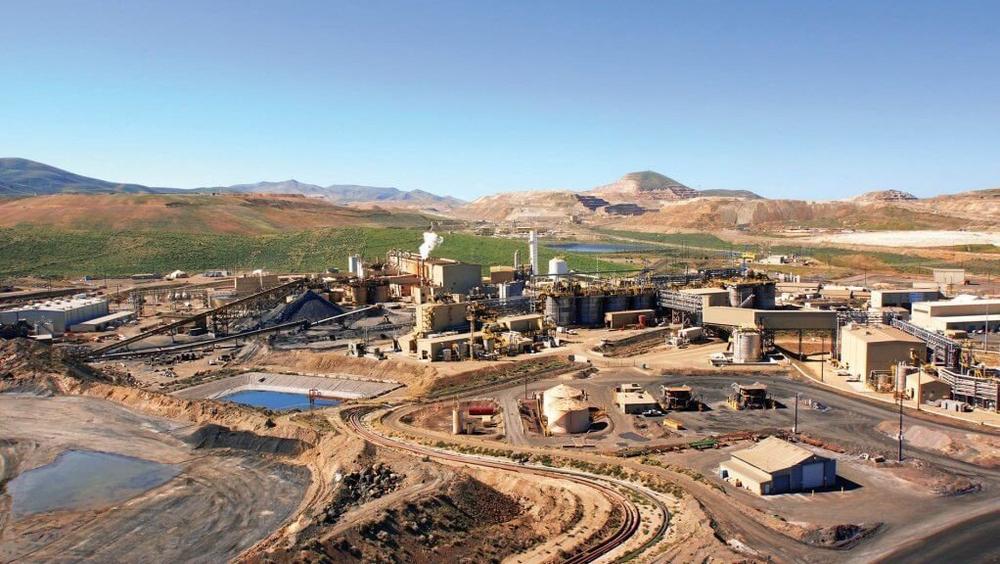

Why so many people put their money exclusively in savings accounts, call money or time deposit accounts and accept the devaluation of their assets remains a mystery. After all, even a 2.5 percent interest rate is nowhere near enough to offset the inflation rate of around eight percent. Yields on life insurance policies can’t help either. Presumably, many citizens shy away from the uncertainties associated with stock ownership. This year in particular, shares have often gone up and down sharply. It is a pity that this prevents many people from investing part of their assets in equities. Because gold shares in particular offer good opportunities in the medium to long term. Gold is simply a commodity that has proven itself in all times, it is unique and cannot be multiplied at will like paper currencies. Gold mining stocks that have the best prerequisites are, for example, Gold Royalty or Gold Terra Resource.

With the Yellowknife City Gold Project, Gold Terra Resource – https://www.youtube.com/watch?v=Dn_KRPL6GDM – owns an immensely large and prospective land package (800 square kilometers) in the Northwest Territories in the Yellowknife Greenstone Belt.

Gold Royalty – https://www.youtube.com/watch?v=3PhJY9cwBv8 – offers diversification for investors as a royalty company. This mainly with royalties on gold properties in North and South America.

Current corporate information and press releases from Gold Royalty (- https://www.resource-capital.ch/en/companies/gold-royalty-corp/ -) and Gold Terra Resources (- https://www.resource-capital.ch/en/companies/gold-terra-resource-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()