Headwinds for gold will ease

Bond yields for US government bonds are rising. From this, it can be deduced that investors are betting on the Fed, which will lower inflation without harming the economy. However, it is not that simple, inflation is virtually unmanageable, and the U.S. economy is not doing well either. If the Fed switches back to quantitative easing, this should give the gold price a boost. Central banks are still fighting inflation by raising interest rates. There are various reasons why the gold price is not higher right now. The real interest rate, i.e. nominal interest rate minus inflation, would be favorable for gold, but now interest rates are rising rapidly.

The growth of the global economy is also a factor that should be taken into account. China’s economy has recovered better than expected. Third-quarter GDP, for example, rose 3.9 percent compared with the third quarter of 2021, despite still-strict covid lockdowns. But the global economy as a whole is expected to grow an estimated 2.7 percent this year, perhaps less. According to the International Monetary Fund, Germany and Italy will have to contend with recession next year. In fact, more than a third of the global economy is expected to contract this year or next. Some analysts are predicting that 2023 will see the weakest economic growth since the global financial crisis of 2009. None of this is good news, and it should make for a rising gold price in the foreseeable future.

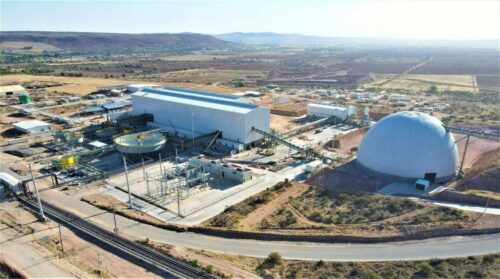

Positioning in gold stocks is possible with Calibre Mining – https://www.youtube.com/watch?v=UYCCTD_R_oE -, a successful gold producer with projects in Nicaragua, Washington and Nevada.

Aztec Minerals – https://www.youtube.com/watch?v=rzWy9OYvJtE – also owns promising properties. These are once the Cervantes property in Mexico (gold, copper) and the historic Tombstone properties in Arizona (gold, silver, zinc, lead).

Latest corporate information and press releases from Calibre Mining (- https://www.resource-capital.ch/en/companies/calibre-mining-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()