Save or invest

Negative real interest rates and high inflation are making it difficult for both savers and investors. Investors are thinking about gold and stock values. The beginning of November was not particularly conducive to the gold price, at the end of November it could look different. Most analysts do not see a trend reversal until there is a turning point by the Federal Reserve. ETF outflows are still continuing, an inflow is not expected until next year. This could then give a boost to the gold price – because demand from other segments is robust. The strength of the U.S. dollar, which is still holding back the gold price, should also continue for a few more months.

In any case, the upcoming CPI inflation report, which will show the latest data on overall inflation in the U.S.A., will be exciting. In many cases, a slight decline is expected. The increase in the CPI index was 8.2 percent in September, and 8.0 percent is expected for October. The CPI index (Consumer Price Index) is used by central banks when making strategic decisions, and it is considered one of the indicators of how a country’s monetary and fiscal policy might develop. If indeed there is a decline in the CPI index, a rise in the price of gold would not be surprising.

There may still be increases before the Fed slows its rate hikes. The Fed funds rate could still rise as high as five or five-and-a-half percent. And market participants already seem to be factoring interest rates of five percent into prices. Since gold and gold mining stocks are always a good bet, perhaps now especially, a look at Condor Gold and Gold Terra Resource is worthwhile.

Condor Gold – https://www.youtube.com/watch?v=TbIYs0Iuh4A – has three projects in Nicaragua, including the main project La India. There is already a positive feasibility study for this one.

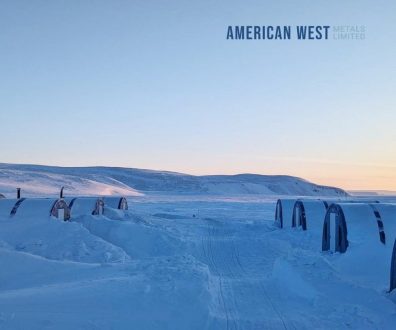

Gold Terra Resource – https://www.youtube.com/watch?v=KehewUd5rVg – is working in the Northwest Territories on its Yellowknife City project. This formerly included the Con and Giant gold mines.

Latest corporate information and press releases from Gold Terra Resource (- https://www.resource-capital.ch/en/companies/gold-terra-resource-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()