-

Deutsche Börse Photography Foundation zeigt gemeinsam mit dem Goethe-Institut Paris Arbeiten der Studierenden von Ute Mahler und Marit Herrmann an der Ostkreuzschule Berlin

Die Ausstellung „With Each Other“ im Rahmen der Ausstellungsreihe „La jeune photographie allemande“ ist vom 10. November 2023 bis zum 15. Januar 2024 im Goethe-Institut Paris zu sehen. Die Ausstellung präsentiert zehn künstlerische Positionen von Studierenden der Ostkreuzschule Berlin. Die Eröffnung der Gruppenausstellung findet am Donnerstag, 9. November 2023 um 18:30 Uhr im Goethe-Institut Paris statt. Ein Presserundgang findet am Donnerstag, 9. November 2023, um 17 Uhr, im Goethe-Institut Paris statt. Im Rahmen der Ausstellungsreihe „La jeune photographie allemande“ zeigen dieses Jahr Studierende von Ute Mahler und Marit Herrmann an der Ostkreuzschule Berlin fotografische Arbeiten, die sich Formen des Miteinanders widmen und der Frage nachgehen, was Menschen heute verbindet. Die Ausstellung mit dem Titel „With…

-

Eurex expands its crypto derivatives suite with Options on FTSE Bitcoin Index Futures

Launch of Options on FTSE Bitcoin Index Futures in USD and EUR, on 23 October 2023 Safe and trusted access to cryptocurrencies on a regulated market with Eurex Eurex was the first exchange in Europe to offer Bitcoin index futures in April 2023. After this successful implementation, Eurex now expands the trusted path to crypto with the launch of Options on FTSE Bitcoin Index Futures. This is another major milestone in Eurex’s ambition to offer secure access to cryptocurrencies in a regulated market environment. Regulated access to cryptocurrencies The cryptocurrency market has undergone a volatile period in the past year. This has highlighted the need of a credible, safe, and…

-

Außerplanmäßige Änderung im SDAX: Krones ersetzt SUSE

. STOXX Ltd. hat eine außerordentliche Änderung der Indexzusammensetzung im SDAX bekannt gegeben. SUSE S.A. wird aus dem SDAX gelöscht, weil der Streubesitz im Zusammenhang mit einer Übernahme unter zehn Prozent gesunken ist. Nach den Regeln des „Guide to the DAX Equity Indices“, Kapitel 5.1.2, erfüllt das Unternehmen damit nicht mehr die Basiskriterien für einen Verbleib in den Auswahlindizes. Der Streubesitzanteil muss mindestens zehn Prozent betragen. Für SUSE S.A. wird aufgrund der Marktkapitalisierung als nächstmöglicher Nachfolger Krones AG in den SDAX aufgenommen. Wie am 5. September 2023 bekannt gegeben, wurde Krones AG im Rahmen der regelmäßigen Indexüberprüfung aus dem MDAX gelöscht und erhielt keinen Platz mehr auf der Rangliste. Der…

-

Unscheduled change in SDAX: Krones replaces SUSE

. STOXX Ltd. has announced an unscheduled component change in the SDAX index. In connection with a takeover, the free float of SUSE S.A. has dropped below ten percent and the company will be deleted from the SDAX. According to the „Guide to the DAX Equity Indices“, section 5.1.2, the company no longer meets the basic criteria required to remain in the selection indices. These require a minimum free float of ten percent. Based on its market capitalization Krones AG is the next possible candidate to replace SUSE S.A. in the SDAX index. As announced on 5 September 2023, Krones AG was deleted from the MDAX as part of the…

-

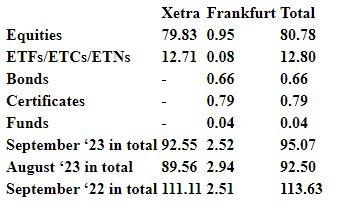

Kassamarkt-Umsatzstatistik für September 2023

An den Kassamärkten der Deutschen Börse wurde im September ein Handelsvolumen von 95,07 Mrd. € erzielt (Vorjahr: 113,63 Mrd. € / Vormonat: 92,50 Mrd. €). Davon entfielen 92,55 Mrd. € auf Xetra (Vorjahr: 111,11 Mrd. € / Vormonat: 89,56 Mrd. €), womit der durchschnittliche Xetra-Tagesumsatz bei 4,41 Mrd. € lag (Vorjahr: 5,05 Mrd. € / Vormonat: 3,89 Mrd. €). Am Handelsplatz Börse Frankfurt wurden 2,52 Mrd. € umgesetzt (Vorjahr: 2,51 Mrd. € / Vormonat: 2,94 Mrd. €). Nach Wertpapierarten entfielen im gesamten Kassamarkt auf Aktien 80,78 Mrd. €. Im Handel mit ETFs/ETCs/ETNs lag der Umsatz bei 12,80 Mrd. €. In Anleihen wurden 0,66 Mrd. € umgesetzt, in Zertifikaten 0,79 Mrd.…

-

Cash market trading volumes in September 2023

Deutsche Börse’s cash markets generated a turnover of €95.07 billion in September (previous year: €113.63 billion / previous month: €92.50 billion). €92.55 billion were attributable to Xetra (previous year: €111.11 billion / previous month €89.56 billion), bringing the average daily Xetra trading volume to €4.41 billion (previous year: €5.05 billion / previous month: €3.89 billion). Trading volumes on Börse Frankfurt were €2.52 billion (previous year: €2.51 billion / previous month: €2.94 billion). By type of asset class, equities accounted for €80.78 billion in the entire cash market. Trading in ETFs/ETCs/ETNs generated a turnover of €12.80 billion. Turnover in bonds was €0.66 billion, in certificates €0.79 billion and in funds €0.04…

-

BNY Mellon selects Eurex Clearing for their first centrally cleared repo trades in Europe

BNY Mellon has chosen Eurex as the first clearing house in Europe to centrally clear repo transactions. The onboarding of the world’s largest custodian is another milestone for Eurex’s cleared repo markets. First transactions have already been executed. Over 160 counterparties registered with Eurex’s repo markets Eurex’s deep liquid and centrally cleared repo markets allow clients to trade repos with over 160 registered participants. This includes commercial and central banks, as well as government financing agencies and a broad range of supranational organizations. They help market participants to efficiently and securely raise or place cash against more than 13,000 domestic and international securities. Frank Gast, Member of the Management Board…

-

Eurex’s Partnership Program for short-term interest rate derivatives gains traction with key stakeholders

The extension of Eurex’s Partnership Program to the short-term interest rate (STIR) derivatives segment has garnered substantial interest. As of publication of this release, 17 participants from the U.S., the U.K., and Continental Europe have registered for the program. The STIR Partnership Program is planned to go live in the last week of October in conjunction with the product re-launch. In June, Eurex announced the expansion of its Partnership Program for interest rate swaps to include the short-term interest rate (STIR) derivatives segment. The STIR Partnership Program will be accompanied by a new liquidity incentive program for liquidity providers for EURIBOR and Euro Short Term Rate (€STR) derivatives which will come into effect beginning of…

-

Goldman Sachs supports listed FX business at Eurex

Goldman Sachs supporting listed FX as Clearing Member and Liquidity Provider Major milestone for Eurex’s FX liquidity hub Eurex, the leading European derivatives exchange and part of Deutsche Börse Group, welcomes Goldman Sachs as a new member of its listed FX Futures business. As leading participant in the global FX markets, Goldman Sachs is supporting an essential number of market players seeking to move their FX business to Eurex. This is another major milestone in Eurex’s ambition to build out its listed FX liquidity hub in Europe. Goldman Sachs is joining the FX business at Eurex both as a trading and clearing member and by offering liquidity for off-book…

-

United Internet to be included in MDAX

Two changes in SDAX, one in TecDAX No adjustments in DAX STOXX Ltd. has announced the new composition of the DAX index family. All changes will become effective on 18 September 2023. According to the „Guide to the DAX Equity Indices“, the scheduled index review in September includes the Regular Exit, Regular Entry, Fast Exit, and Fast Entry rules. The following changes will be made: MDAX: Addition Deletion United Internet AG Krones AG SDAX: Addition Deletion thyssenkrupp nucera AG & Co. KGaA United Internet AG IONOS Group SE Basler AG TecDAX: Addition Deletion Energiekontor AG Eckert & Ziegler Strahlen- und Medizintechnik AG DAX, MDAX, SDAX and TecDAX represent the largest companies (by free float market capitalization)…