-

Cash market trading volumes in May 2023

Deutsche Börse’s cash markets generated a turnover of €106.54 billion in May (previous year: €141.06 billion / previous month: €85.62 billion). €103.79 billion were attributable to Xetra (previous year: €138.08 billion / previous month €83.18 billion), bringing the average daily Xetra trading volume to €4.72 billion (previous year: €6.28 billion / previous month: €4.62 billion). Trading volumes on Börse Frankfurt were €2.75 billion (previous year: €2.99 billion / previous month: €2.44 billion). By type of asset class, equities accounted for €89.85 billion in the entire cash market. Trading in ETFs/ETCs/ETNs generated a turnover of €15.16 billion. Turnover in bonds was €0.59 billion, in certificates €0.90 billion and in funds €0.04…

-

Clearstream and Proxymity to launch digital general meeting announcement service in Germany and Luxembourg

Proxymity, the leading digital investor communication platform, and Clearstream, the post-trade business for global markets, have expanded their partnership to create a digital general meeting announcement solution. Historically, communication between issuers and investors was initiated through multiple disparate sources and using different modalities, causing delays and a fragmented process for intermediaries and investors. With the new platform, Proxymity and Clearstream are looking to automate issuer investor communication to resolve these issues and facilitate better proxy voting and corporate event communications for all parties involved. The central platform will enable issuers and their issuer agents to improve corporate event communications between intermediaries and investors by publishing “golden record” general meeting…

-

Clearstream und Proxymity schaffen digitale Plattform zur Bekanntgabe von Hauptversammlungen in Deutschland und Luxemburg

Proxymity, die führende digitale Kommunikationsplattform für Investoren, und Clearstream, das weltweit agierende Nachhandelsunternehmen, haben ihre Partnerschaft erweitert, um eine digitale Lösung für die Bekanntgabe von Hauptversammlungen zu schaffen. In der Vergangenheit wurde die Kommunikation zwischen Emittenten und Investoren von mehreren disparaten Quellen und unter Nutzung unterschiedlicher Modalitäten initiiert, was zu Verzögerungen und komplexen Prozessen für Intermediäre und Investoren führte. Mit der neuen Plattform wollen Proxymity und Clearstream die Kommunikation zwischen Emittenten und Investoren automatisieren, um diese Probleme zu lösen und die Stimmabgabe und Kommunikation von Unternehmensveranstaltungen für alle Beteiligten zu erleichtern. Die zentrale Plattform wird es Emittenten und deren beauftragten Dritten ermöglichen, besser mit Intermediären und Investoren zu Unternehmensveranstaltungen zu…

-

State Street executed first centrally cleared repo trades in Europe at Eurex

State Street has chosen Eurex as the first clearing house outside the U.S. to trade and centrally clear repo transactions. The onboarding of one of the world’s largest custodian banks is another milestone for Eurex’s cleared repo markets. First transactions have already been successfully executed. State Street has joined Eurex through its German subsidiary, State Street Bank International GmbH (SSBI). The power of multilateral netting will provide tangible risk management and collateral optimization benefits to State Street’s broad client base. Through its Eurex membership, State Street will be able to expand its European franchise and service offering. Over 160 counterparties registered with Eurex’s repo markets Eurex’s deep liquid and centrally…

-

Clearstream creates new Luxembourg-based bank for global institutional fund investors

New banking entity dedicated to serving global banking, custodian and wealth management community for international fund processing High asset safety, automation and efficiency for clients in a new agile banking environment Close interlinkage with Clearstream’s Securities Services business, leveraging from established global market infrastructure Clearstream, the global post-trading services provider, has created a new bank in Luxembourg dedicated to serving institutional fund investors: Clearstream Fund Centre S.A. The new entity operates under a commercial banking licence in Luxembourg. It will be an important cornerstone of Deutsche Börse’s and Clearstream’s Fund Services, the business segment which provides fund execution, distribution and data management. The new bank Clearstream Fund Centre S.A. will…

-

Cash market trading volumes in March 2023

Deutsche Börse’s cash markets generated a turnover of €140.21 billion in March (previous year: €217.01 billion / previous month: €113.31 billion). €136.42 billion were attributable to Xetra (previous year: €212.14 billion / previous month €110.38 billion), bringing the average daily Xetra trading volume to €5.93 billion (previous year: €9.22 billion / previous month: €5.52 billion). Trading volumes on Börse Frankfurt were €3.79 billion (previous year: €4.87 billion / previous month: €2.93 billion). By type of asset class, equities accounted for €116.44 billion in the entire cash market. Trading in ETFs/ETCs/ETNs generated a turnover of €21.43 billion. Turnover in bonds was €1.05 billion, in certificates €1.24 billion and in funds €0.05…

-

Clearstream launches Collateral Mapper to customise equity collateral utilisation

Collateral Mapper provides up-to-date data and pre-emptive analytics about collateral portfolios and equity capacities The tool allows for higher volumes of transaction execution by more effectively allocating collateral assets Clearstream has launched a new data-based solution to optimise collateral management: the Collateral Mapper. Clearstream’s Collateral Mapper allows clients to make well-informed decisions by providing them with an automated and complete view of their collateral positions. It summarises complex sets of reports on collateral usage in an intuitive dashboard and evaluates the collateral potential of an equity portfolio. Furthermore, it identifies the spare capacity in rebalancing an inventory towards equity thereby highlighting the possibility to free up higher quality assets. The…

-

Eurex Clearing supports sustainable transformation with new innovative ESG Clearing Compass

– Eurex ESG Clearing Compass will include two services, the ESG Portfolio Assessment and the ESG Visibility Hub. – Eurex Clearing is supporting sustainable transformation of clients by creating transparency regarding cleared portfolios and counterparties. – Source of the data is ISS ESG, a globally leading provider of ESG data and analytics. Eurex Clearing, one of the leading central counterparties globally, announces the introduction of its new ESG Clearing Compass on 3 April 2023. It will include two services, the ESG Portfolio Assessment and the ESG Visibility Hub. With these new services, Deutsche Börse aims to support the sustainable transformation journey of clearing members and their clients by creating more…

-

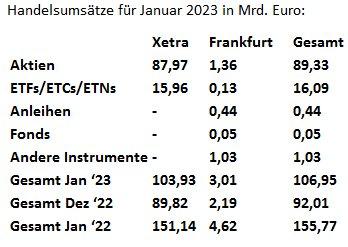

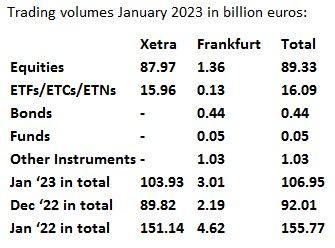

Kassamarkt-Umsatzstatistik für Januar 2023

An den Kassamärkten der Deutschen Börse wurde im Januar ein Handelsvolumen von 106,95 Mrd. € erzielt (Vorjahr: 155,77 Mrd. € / Vormonat: 92,01 Mrd. €). Davon entfielen 103,93 Mrd. € auf Xetra (Vorjahr: 151,14 Mrd. € / Vormonat: 89,82 Mrd. €), womit der durchschnittliche Xetra-Tagesumsatz bei 4,72 Mrd. € lag (Vorjahr: 7,20 Mrd. € / Vormonat: 4,28 Mrd. €). Am Handelsplatz Börse Frankfurt wurden 3,01 Mrd. € umgesetzt (Vorjahr: 4,62 Mrd. € / Vormonat: 2,19 Mrd. €). Nach Wertpapierarten entfielen im gesamten Kassamarkt auf Aktien 89,33 Mrd. €. Im Handel mit ETFs/ETCs/ETNs lag der Umsatz bei 16,09 Mrd. €. In Anleihen wurden 0,44 Mrd. € umgesetzt, in Zertifikaten 1,03 Mrd.…

-

Cash market trading volumes in January 2023

Deutsche Börse’s cash markets generated a turnover of €106.95 billion in January (previous year: €155.77 billion / previous month: €92.01 billion). €103.93 billion were attributable to Xetra (previous year: €151.14 billion / previous month €89.82 billion), bringing the average daily Xetra trading volume to €4.72 billion (previous year: €7.20 billion / previous month: €4.28 billion). Trading volumes on Börse Frankfurt were €3.01 billion (previous year: €4.62 billion / previous month: €2.19 billion). By type of asset class, equities accounted for €89.33 billion in the entire cash market. Trading in ETFs/ETCs/ETNs generated a turnover of €16.09 billion. Turnover in bonds was €0.44 billion, in certificates €1.03 billion and in funds €0.05…